Location of Sigmund Freud’s ashes in London.

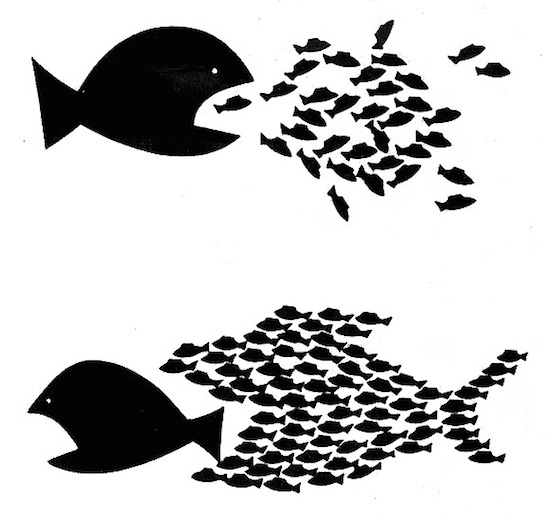

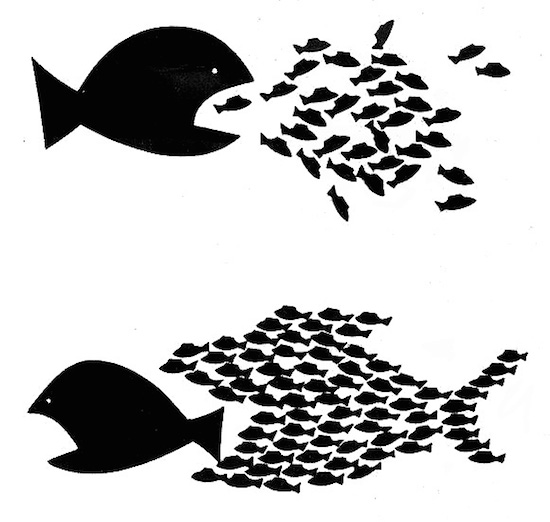

The American Psychiatric Association has joined the American Medical Association, the American Hospital Association and the American Academy of Family Physicians in warning U.S. antitrust regulators about the effects of two proposed health-insurance mergers. The psychiatrist group asserts that the mergers could worsen access to mental-health care.

Anthem Inc. would become the largest U.S. health insurer through a proposed $47 billion acquisition of Cigna Corp. and Aetna plans to buy Humana Inc. to make it the largest provider of very lucrative Medicare Advantage plans.

Reuters has noted that ”{a}ntitrust concerns have kept investors and other experts skeptical about the likelihood the deals will make it past the U.S. Department of Justice antitrust reviews now underway.

“There is also political opposition. Earlier this week, Democrats and Republicans grilled Anthem and Aetna during a Senate hearing on the effects of insurer consolidation.”

On the other hand, health insurers give lots of campaign cash to federal (and state) legislators…

The psychiatry group, which has 36,000 physicians, complained that insurers have too often denied mental-health benefits compared to benefits involving other ailments and that their networks of insurance-affiliated psychiatrists were thin and likely to get more so.