Proposed huge health-insurance mergers parallel what has been happening among providers, with this year on pace to have the most U.S. hospital deals since 1999; 71 have been announced through the end of August, says Irving Levin Associates, which follows healthcare-sector transactions.

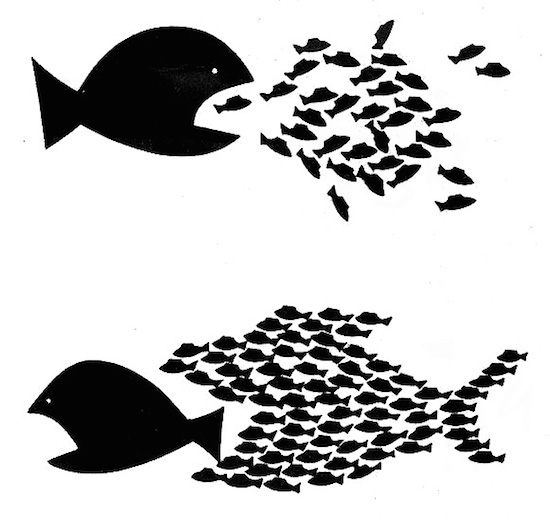

“The supersizing, which hasn’t been slowed so far by signals of regulatory concern about health-care consolidation, reflects efforts by companies in both industries to gain the scale and heft to succeed amid changes unleashed or accelerated by the {Affordable Care Act). Those include growing pressures to constrain costs, and new forms of payment that require providers to meet efficiency and care-quality goals. Health systems are adding hospitals, doctor practices and a range of other services that enable them to manage all of a patient’s care. And each industry is bulking up to amass leverage in contract negotiations against the other.”

“The ACA is a trigger,” Robert Kocher, a former White House health adviser now at venture-capital firm Venrock, told the paper. “{A}s providers have gotten consolidated, payers have been finding they’re getting pushed by providers saying, ‘Take my rates or you’ll have no network.’ The health-plan deals aim ‘to help balance the power.”’