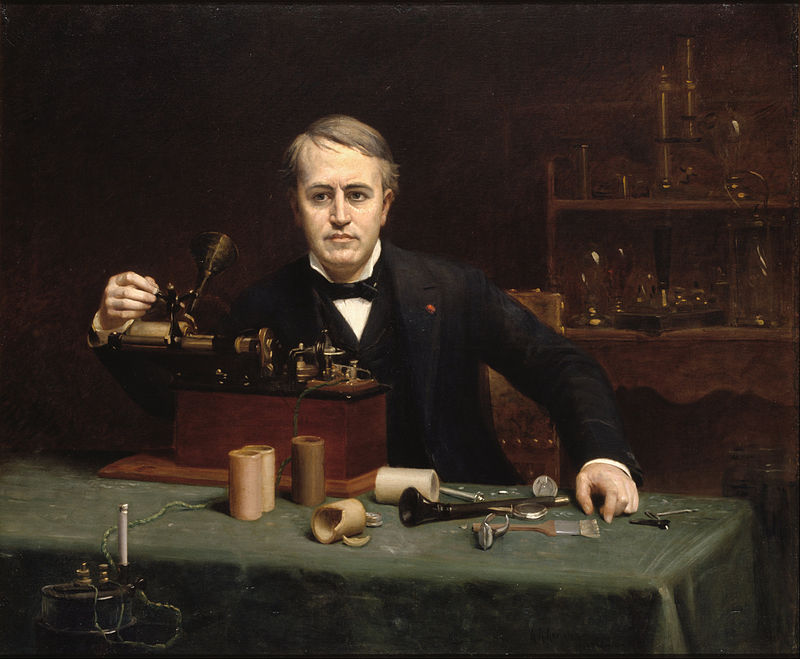

Thomas Edison in his lab (1890), by Abraham Archibald Anderson.

In a Health Affairs piece, Cindy Brach writes about how hospital systems need “contextual evidence” before adopting innovations.

Among the issues to be faced, she writes:

“First, health system leaders need to learn how the innovation worked in the past. Where has it been used, and what’s the evidence that it worked? When evaluating the evidence, understanding the context in which the innovation operated and how it is similar or different from their own environment is critical.”

“Second, health system leaders need to determine whether the innovation will solve any of their system’s problems or contribute to achieving their system’s goals. If there’s a problem that needs fixing, carefully define the problem and honestly assess whether the innovation will address the root cause.”

“Third, think about whether the innovation is compatible with the mission, values, and culture of the organization. A clash with a system’s mission and values is likely to be a fatal flaw. The occurrence of a cultural clash is less cut and dry. Organizational culture, that is, the norms that guide behavior in the organization, is not monolithic. Several organizational cultures—such as patient-care and patient-safety cultures, business and management cultures, and professional and interpersonal cultures—come into play.”

“It’s not only about dollars and cents. Hard-to-quantify aspects of a business case for adoption include the benefits to patient and families, staff, and other stakeholders. These might include increased patient involvement in health care decisions, better health outcomes, reduced stress on the workforce, or enhanced reputation. An innovation may be responsive to requirements of insurers, regulators, or accreditation organizations. Non-financial factors, such as a mission-driven system’s imperative to satisfy its charge, have to be weighed along with financial matters.”

To read the Health Affairs piece, please hit this link.