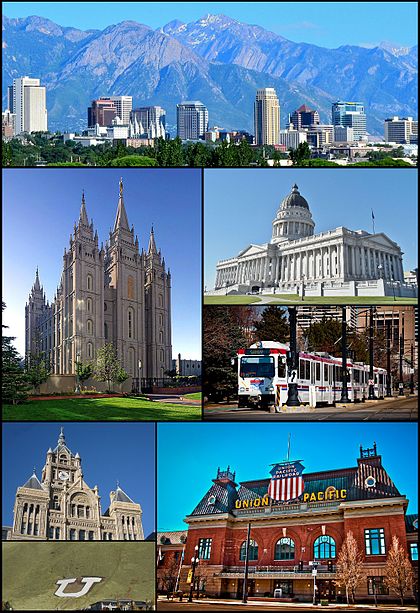

Salt Lake City.

Hospitals around America are watching nonprofit Intermountain Healthcare, a Salt Lake City-based hospital system, as it tries, in the words of The New York Times, ”something virtually unheard-of: promising to sharply cut costs rather than pass them on.

“Its new health plan, SelectHealth Share, is guaranteeing to hold yearly rate increases to one-third to one-half less than what many employers across the country typically face,” The Times reported.

“To help keep the rate increases roughly in line with a rise in consumer prices, Intermountain, which operates 22 hospitals and employs 1,400 doctors, says it will produce savings of $2 billion over the next five years.

“Health systems and insurers are closely watching Intermountain’s rollout. It has established itself as a leading health system by tracking and analyzing costs and the quality of patient care, allowing it to improve treatments and reduce unnecessary expenses.”

Intermountain’s plan is “the first innovative thing we’ve seen in a long time,” Dave Jackson, managing partner for FirstWest Benefit Solutions, in Orem, Utah, told The Times. “Share has got everybody at the table — everybody’s got accountability and got things to do.”

“Some systems might be more likely to reduce services or shrink their money-losing operations if they tried to guarantee a long-term lock on price increases,” The Times reported.

“But a few are heading in a similar direction to Intermountain’s, experimenting with ways that avoid the traditional piecemeal approach of fee-for-service care. The idea of locking in rate increases — Intermountain’s Share program sets the increase at approximately 4 percent — is particularly attractive to employers because coverage then becomes a predictable expense.”