By JORDAN RAU

For Kaiser Health News

At age 88, Elizabeth Fee looked pregnant, her belly swollen after days of intestinal ailments and nausea. A nurse heard a scream from Fee’s room in a nursing home, and found her retching “like a faucet” before she passed out.

The facility where she died in 2012 was affiliated with a respected San Francisco hospital, California Pacific Medical Center, and shared its name. Fee had just undergone hip surgery at the hospital, and her family, pleased with her care, said they chose the nursing home with the hospital’s encouragement.

Laura Rees, Fee’s elder daughter, said she was never told that the nursing home had received Medicare’s worst rating for quality — one star. Nor, she said, was she told that state inspectors had repeatedly cited the facility for substandard care, including delayed responses to calls for aid, disrespectful behavior toward patients and displaying insufficient interest in patients’ pain.

“They handed me a piece of paper with a list of the different facilities on it, and theirs were at top of the page,” Rees said in an interview. “They kept pointing to their facility, and I was relying on their expertise and, of course, the reputation of the hospital.”

Fee had an obstructed bowel, and state investigators faulted the home for several lapses in her care related to her death, including giving her inappropriate medications. In court papers defending a lawsuit by Fee’s family, the medical center said the nursing home’s care was diligent. The center declined to discuss the case for this story.

The selection of a nursing home can be critical: 39 percent of facilities have been cited by health inspectors over the past three years for harming a patient or operating in such a way that injuries are likely, government records show.

Yet many case managers at hospitals do not share objective information or their own knowledge about nursing home quality. Some even push their own facilities over comparable or better alternatives.

“Generally hospitals don’t tell patients or their families much about any kind of patterns of neglect or abuse,” said Michael Connors, who works at California Advocates for Nursing Home Reform, a nonprofit in San Francisco. “Even the worst nursing homes are nearly full because hospitals keep sending patients to them.”

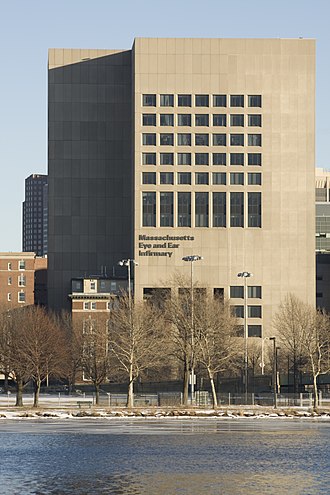

Hospitals say their recalcitrance is due to fear about violating a government decree that hospitals may not “specify or otherwise limit” a patient’s choice of facilities. But that rule does not prohibit hospitals from sharing information about quality, and a handful of health systems, such as Partners HealthCare in Massachusetts, have created networks of preferred, higher-quality nursing homes while still giving patients all alternatives.

Such efforts to help patients are rare, said Vincent Mor, a professor of health services, policy and practice at the Brown University School of Public Health in Providence. He said that when his researchers visited 16 hospitals around the country last year, they found that only four gave any quality information to patients selecting a nursing home.

“They’re giving them a laminated piece of paper” with the names of nearby nursing facilities, Mor said. For quality information, he said, “they will say, ‘Well, maybe you can go to a website,’” such as Nursing Home Compare, where Medicare publishes its quality assessments.

The federal government may change this hands-off approach by requiring hospitals to provide guidance and quality data to patients while still respecting a patient’s preferences. The rule would apply to information not only about nursing homes but also about home health agencies, rehabilitation hospitals and other facilities and services that patients may need after a hospital stay.

“It has a substantial opportunity to make a difference for patients,” said Nancy Foster, a vice president at the American Hospital Association.

But the rule does not spell out what information the hospitals must share, and it has yet to be finalized — more than a year after Medicare proposed it. The rule faces resistance in Congress: The chairman of the House Freedom Caucus, Rep. Mark Meadows, R-N.C., has included it on a list of regulations Republicans should block early next year.

The government has created other incentives for hospitals to make sure their patient placements are good. For instance, Medicare cuts payments to hospitals when too many discharged patients return within a month.

“Hospitals didn’t use to care that much,” said David Grabowski, a professor of healthcare policy at Harvard Medical School. “They just wanted to get patients out. Now there’s a whole set of payment systems that reward hospitals for good discharges.”

But sometimes hospitals go too far in pushing patients toward their own nursing homes. In 2013, for instance, regulators faulted a Wisconsin hospital for not disclosing its ties when it referred patients to its own nursing home, which Medicare rated below average. In 2014, a family member told inspectors that a Massachusetts hospital had “steered and railroaded” her into sending a relative to a nursing home owned by the same health system.

Researchers have found that hospital-owned homes are often superior to independent ones. Still, a third of nursing homes owned by hospitals in cities with multiple facilities had lower federal quality ratings than at least one competitor, according to a Kaiser Health News analysis.

The Lowest Rating

But state inspectors found shortcomings in seven visits to the nursing home between August 2009 and October 2011, records show. Inspectors found expired medications during two visits and, at another, observed a nurse washing only her fingertips after putting an IV in a patient with a communicable infection. Medicare’s Nursing Home Compare gave the nursing home where Elizabeth Fee died one star out of five, meaning it was rated “much below average.” The hospital’s case managers told Fee’s family that the nursing home was merely an extension of the hospital and that “my mother would receive the same excellent quality of care and attention,” said Rees, her daughter.

Just four months before Fee arrived, inspectors cited the nursing home for not treating patients with dignity and respect and for failing to provide the best care. One patient told inspectors that her pain was so excruciating that she couldn’t sleep but that nurses and the doctor did not check to see whether her pain medications were working.

“Nobody listens to me,” the patient said. “I was born Catholic, and I know it’s not right to ask to die, but I want to die just to get rid of the pain.”

Fee ate little and had few bowel movements, according to the state health investigation. Fee’s family had hired a private nurse, Angela Cullen, to sit with her. Cullen became increasingly worried about Fee’s distended belly, according to Cullen’s affidavit taken as part of the lawsuit. She said her concerns were brushed off, with one nurse declining to check Fee’s abdomen by saying, “I do not have a stethoscope.”

On the morning of her death, an X-ray indicated Fee might have a bowel obstruction or other problem expelling stool, the inspectors’ report said. That evening, after throwing up a large quantity of matter that smelled of feces, she lost consciousness. She died of too much fluid and inhaled fecal matter in her lungs, the report said.

Bills Of More Than $150,000

Sutter Health, the nonprofit that owns the medical center and the nursing home, emphasized in court papers that Elizabeth Fee arrived at the facility with a low count of platelets that clot blood. Sutter’s expert witness argued that the near-daily visits from a physician that Fee received “far exceeds” what is expected in nursing home care.In a court ruling, Judge Ernest Goldsmith of the San Francisco Superior Court wrote that Nancy Fee’s younger daughter, Nancy, “observed her mother drown in what appeared to be her own excrement.” Kathryn Meadows, the family’s attorney, said in a court filing that the nursing home’s bills exceeded $150,000 for the three-week stay.

The physician and his medical group have settled their part of the case and declined to comment or discuss the terms; the case against Sutter is pending. California’s public health department fined Sutter $2,000 for the violations, including for delaying 16 hours in telling the physician about Fee’s nausea, vomiting and swollen abdomen. Last year, Sutter closed the nursing home.

A week or so after Fee died, a letter addressed to her from California Pacific Medical Center arrived at her house. It read: “We would appreciate hearing about your level of satisfaction with the care you received on our Skilled Nursing Rehabilitation Unit, the unit from which you were just discharged.”