If the Supremes throw out the credits, we’d guess that many anxious Republican lawmakers will vote to extend the credits to buy the GOP time to enact a broader overhaul of health law the party has long opposed.

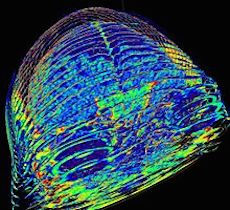

3D reconstruction of the brain and eyes from CT scanned DICOM images

By JAY HANCOCK, for Kaiser Health News

Douglas White knew high-deductible insurance is supposed to make patients feel the pain of medical prices and turn them into smart shoppers. So he shopped.

He called around for price quotes on the CT scan his doctor ordered. After all, his plan’s $2,000 deductible meant paying the full cost out of pocket. Using information from his insurer, he found a good deal — $473.53 at Coolidge Corner Imaging in Boston, a half hour from his house.

But the bill he got later was for $1,273.02 — more than twice as much — from a hospital he had no idea was connected to the imaging center.

“I was shocked,” said White, a doctor of physical therapy who thought he knew his way around the medical system. “If I get tripped up, the average consumer doesn’t have the slightest chance of effectively managing their health expenses.”

A national study by Consumers Union basically comes to the same conclusion, suggesting that there are millions of Douglas Whites lost in the medical billing maze.

Nearly one in three Americans with private health insurance surveyed by the research group got a surprise medical bill in the past two years — defined as when a plan paid less than expected and doctors and hospitals tried to recover the balance from the patient.

Of those with surprise bills, nearly a fourth got bills from doctors they had no idea were involved in their care and nearly two-thirds were charged more than they expected.

“When we talk about transparent healthcare and the need for consumers to shop around, it’s just not possible in many situations,” said Blake Hutson, a senior associate for Consumers Union, the policy arm of Consumer Reports. “Even if you work for a big company and have what you think is a good health insurance plan, you can get a surprise medical bill.”

The deductible is what patients pay before insurance kicks in. The higher the deductible, the more you pay out of pocket. Deductibles of $3,000 or $5,000 are not unusual these days, although the health law caps out-of-pocket costs at $6,600 for individuals and $13,200 for families.

Making plan members pay more in this way is supposed to prompt them to check prices and put competitive pressure on medical providers.

The problem is that you can’t buy medical services the way you buy a phone plan. Doctors, hospitals and other providers generally don’t advertise their prices and often keep them confidential, even when asked by patients about what to expect. Providers charge different amounts for the same service depending on the insurance.

One episode of treatment can generate bills from multiple caregivers, especially in the hospital.

A new study by the Employee Benefit Research Institute shows that members of high-deductible plans have higher incomes and are more educated on average than the typical American. But a post-grad degree from MIT might not be enough to figure out some bills.

The system is so complicated that one patient in three who got a surprise bill in the Consumers Union study didn’t investigate or fight it.

“I didn’t think it would make a difference,” or “I was confused about what to do” were common reasons for inaction.

That’s the wrong response, said Karen Pollitz, a senior fellow at the Kaiser Family Foundation who studies how the health system affects consumers. (Kaiser Health News is an editorially independent project of the foundation.)

“It’s always advisable to ask questions if you receive a surprise bill or if insurance pays less than you expect,” she said. “Mistakes happen and following up can save you money. If it gets too confusing or frustrating, ask for help.”

Consumers Union offers an online tool for finding the relevant agency in your state and its contact information.

White’s billing problems were cleared up — many months and phone calls later and after a reporter started inquiring.

His plan, Harvard Pilgrim Healthcare, said it had given him an incorrect quote for the CT scan last fall. The plan eventually paid the imaging center the full $1,273, saying it wasn’t White’s fault that the plan’s quote was wrong.

The bill had come from Brigham and Women’s Hospital, which owned the radiology center, even though White said there was no indication of that when he went to get the scan.

Harvard Pilgrim said it didn’t know Brigham and Women’s was affiliated with the center, either. Hospital-owned facilities are often far more expensive than independently owned doctors’ offices.

So how does he like the transparency revolution in healthcare, boosting competition and empowering patients?

“There is nothing transparent about most healthcare billing,” White said.

In Medicaid-expansion states

- “Primary-care visits from Medicaid patients in expansion states increased from 15.6 percent in 2013 to 21.5 percent in 2015.

- “Medicaid patients who were new in 2014, the first year of the {ACA} expansion, returned to the same practice at a higher rate than those who were new to Medicaid in 2013.

- “Uninsured adult visits dropped 2.2 percentage points, from 4.6 percent in 2013 to 2.4 percent in 2015.

- “Commercial visits decreased from 65.2 percent in 2013 to 62.8 percent in 2015 in expansion states.

Non-Medicaid-expansion states

- “The proportion of visits from Medicaid patients to primary-care providers in non-expansion states dropped from 9.4 percent in 2013 to 8.9 percent in 2015.

- “Uninsured adult visits dropped 1.5 percentage points between 2013 and 2015, from 7.2 percent to 5.7 percent.

- ” Visits from commercially insured patients increased from 66.1 percent in 2013 to 68.1 percent in 2015.”

“But instead of affordable Fords and Chevys, our hometown {Boston area} firms are cranking out Lamborghinis and Bentleys. They make expensive drugs that are steering the healthcare system toward a precipice. ”

“{T}he industry has been doing everything in its power to make itself look like Monty Burns, the money-hungry mogul who owns the nuclear power plant on The Simpsons.”

One big way Big Pharm continues to drive up costs is by doing all that it fan to keep out biosimilars. “Express Scripts estimated that if just 11 biosimilars were introduced for drugs coming off parent, about $250 billion could be saved over a decade.”

Then there’s the surging pay of execs in biotech.

The Globe notes: “Finally, the price of the products has started to make headlines. A new two-drug combination from Vertex to treat cystic fibrosis, on the verge of FDA approval, is expected to cost north of $300,000 per year. ”

And The Globe says:

{“T}he price is often determined by asking, ‘What’s the highest price I can charge and get away with,’ said Alison Taunton-Rigby, a former biotech executive who serves on several corporate and nonprofit boards. Speaking at a recent industry conference, Taunton-Rigby said, ‘It’s an attitude we need to talk about. I think we actually have a black mark against us as an industry.”’

But insurers are pushing back.

“Tony Dodek, associate chief medical officer at Blue Cross Blue Shield of Massachusetts, says high-priced ‘specialty drugs’ represent just 1 percent of the prescriptions handed to Blue Cross’ members, but 25 percent of the insurer’s spending on drugs, a share that is rising rapidly. ‘That’s not sustainable,’ Dodek says.”

Hospital Impact reports that the commission continues to challenge, often with success, completed mergers, “where the effects were demonstrable, rather than seeking to enjoin mergers before they were completed, and to focus on the bargaining power of each hospital system in its negotiations with managed care organizations.”

Here’s some good advice on what physicians should do if insurers warn them they are costing too much and do not meet the “cost and quality designation” determined by the insurer — and thus may be thrown out of the insurers’ networks.

Meanwhile, Medscape reports, “{S}ome insurers are using cost and quality data to sort physicians within networks into tiers with different co-payments and deductibles.”

And now, says MedScape, “{S}ome insurers are using cost and quality data to sort physicians within networks into tiers with different co-payments and deductibles.”

The analysis in HealthAffairs found that the ACA would add about $273.6 billion in administrative costs in 2014-22, including $172.2 billion in higher private insurance overhead.

David Himmelstein, M.D., and Steffie Woolhandler, M.D., professors at the City University of New York School of Public Health and lecturers at Harvard Medical School, cite rising enrollment in private plans, the law’s Medicaid expansion and the cost of setting up and running health-insurance exchanges.

Instead of the ACA, it would have cheaper, easier and more efficient to simply extend the traditional Medicare program to everyone — but that was seen as ideologically and politically impossible. So we have a system whose fragmentation and contradictory incentives and disincentives maximizes costs as each constituency demands its cut.

The latest estimate means about $1,375 in extra administrative costs per newly insured person per year, according to the report. That’s “over and above what would have been expected had the law not been enacted,” Dr. Himmelstein wrote on the Health Affairs blog.

The lawsuit, in Cuyahoga Common Pleas Court, seeks damages of at least $400 million. It alleges breach of contract, breach of fiduciary duty and fraud, among others allegations.

The suit will probably encourage activists elsewhere to sue big hospital systems consolidating their services and closing community hospitals to do so.

“A ‘good’ merger or affiliation is one that increases the value of healthcare by reducing costs, improving outcomes, or both, thereby enabling providers to generate and respond to competition. The all-too-common alternative is a merger intended to reduce competition — to ensure referral streams (which would otherwise be earned through superior offerings) or to help providers negotiate higher prices and thereby avoid the difficult work of improving outcomes and efficiency.”

“Although regulators can sometimes stop a ‘bad’ merger, they cannot create a good one,” they note.

“The harsh reality is that it’s difficult to find well-documented examples of mergers that have generated measurably better outcomes or lower overall costs — the greater value that is publicly touted as the motivation underlying these combinations. The most consistently documented result of provider mergers is higher prices, particularly when the merging hospitals are in close proximity. Providers’ hopes for improving value by consolidating and then integrating care within merged entities remain objectives rather than accomplishments in most organizations.”

Many procedures and treatments currently being used have no known benefit.

They note how “Less healthcare stirs fears of rationing, or withholding care simply to save money….Doctors and health systems may earn more money when they do more.”

“We felt that focusing on the harms of overuse and the benefits of less healthcare might counter these forces and educate Americans that there are also often good reasons to ‘withhold’ care.”

“Unfortunately, awareness of the harms of overuse of medical care probably isn’t enough to achieve the ‘less is more’ goal. {But} we are very encouraged to see that many new efforts are underway to reduce overuse, including educational initiatives, computer-based alerts, and decision support tools, peer review and feedback, and system changes supported by implementation and behavioral sciences.

“Important changes are also occurring in the U.S. healthcare system, moving us away from fee-for-service medicine, which rewards high-volume care regardless of appropriateness, towards bundled payments, Accountable Care Organizations, and capitated systems that can better align incentives towards high-value care.”